Last week, the National Coffee Association released their semi-annual report on the state of coffee consumption in America, where they found that out-of-home coffee had returned to pre-pandemic levels. But even with a little latte to go, as a treat, folks by and large were still making their own coffee, with 81% of all participants who consumed coffee the previous day doing so at home. Now, a new study has come out that expands on these results, finding that consumer demand for whole bean has skyrocketed over where it was last year at the same time.

The new report is by the e-commerce accelerator platform Pattern, who analyzed consumer shopping data on Amazon for every day in 2023 and 2024 (to date) to determine how folks were consuming their coffee at home. They found a significant increase from Q3 2023 to Q3 2024 for in-home coffee preparation, and it all starts with whole bean coffee.

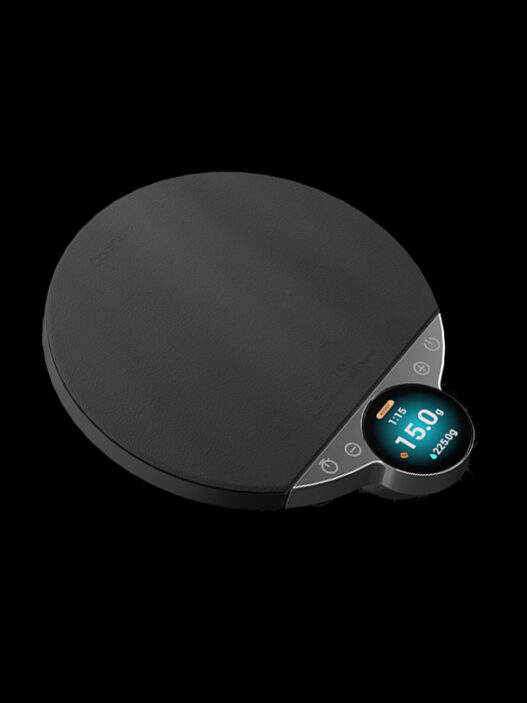

Year over year, Pattern found whole bean coffee to have a 46% increase in demand among Amazon shoppers, placing in third in overall percentage point jump, behind drip coffee maker with a 66% increase and espresso machine with 50%. And while these two preparation methods don’t require whole bean coffee, other accessories like coffee bean storage and coffee scale saw jumps of 20% and 13%, lending credence to the idea that more folks are taking their coffee prep more seriously, which generally starts with the switch to whole bean.

Interestingly enough, the demand on Amazon for coffee grinders only saw a 3% increase in the same timeframe. This can perhaps be explained away by the face that coffee grinders are the second most in-demand coffee item on Amazon that Pattern tracked—behind only the very broad “coffee maker.” An already high demand makes it more difficult to see these big double-digit jumps. A 3% increase year of year at this volume is not insignificant, especially when compared to coffee maker, which actually saw a 1% decrease.

Further corroborating the NCA’s report, Pattern found an 18% decrease in demand for cold brew coffee makers. Cold brew—and cold coffee drinks in general—are typically associated with coffee out of the home, and the downward trend in folks looking to make their own version of one of the most popular coffee drinks jibes with the NCA’s findings about out-of-home coffee consumption returning to pre-pandemic levels.

When digging deeper into what coffee roasters may be benefitting from an increased demand for whole bean coffee, the results—particularly for specialty coffee brands—were uneven. While Stumptown saw the largest jump of any roaster with a whopping 92%, similarly situated specialty roasters like La Colombe only saw a 4% increase. Intelligentsia actually decreased by 22% while Keurig K-Cup increased by 65%.

Overall, the findings show the needle steadily moving in the right direction. Folks are taking their coffee more seriously and investing in the proper equipment to do so. For more information, visit Pattern’s official website.

Zac Cadwalader is the managing editor at Sprudge Media Network and a staff writer based in Dallas. Read more Zac Cadwalader on Sprudge.