Coffee, it appears, may have been disrupted enough. Tech’s favorite industry to rethink and revolutionize over the past few years has seen its fair share of newcomers looking to shake up your morning brew. But recently, two of the bigger names in the coffee tech space—Cometeer and Atomo—have made significant cuts to their labor force, this after raising hefty rounds of capital. Within a wider market milieu in which “financial conditions continue to tighten and monetary policy turns even more restrictive” (per J.P. Morgan) the freewheeling days of influx after influx of exploratory venture capital into the outer reaches of the coffee space may have at last reached the plunger phase, like so many French press pots ready to brew.

It began back in December with Cometeer, the maker of flash-frozen coffee concentrate spheres. As we reported back in 2021, the Massachusetts-based company raised nearly $100 million across multiple rounds of funding, which they used to coax industry veterans to join the team as well as create limited edition, high-end frozen coffee box sets (including a Gesha). Since then they have worked with some of the biggest roasters in the country, including George Howell, Onyx Coffee Lab, Go Get Em Tiger, Black & White, and many, many more.

In late 2022 the company announced what some have depicted as sudden and unceremonious cuts to their workforce across departments, timed right before the holiday season. The reason for the layoffs, according to BevNet, is an “attempt to cut costs.” The brand did, however, choose to move forward with a tone-deaf marketing campaign which featured Cometeer emissaries doling out coffee to Goldman Sachs employees, themselves under threat of a looming downsize.

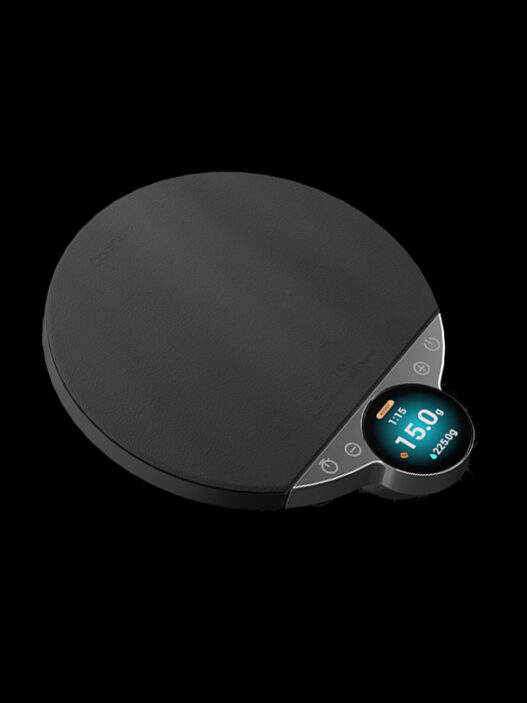

Similarly, the “molecular coffee” company Atomo—whose various funding raises and attendant Bloomberg puff piece we’ve covered with some skepticism here at Sprudge—is going through their own “strategic realignment,” a soft-shoe term for layoffs. The Seattle-startup has raised over $50 million in investments, $40 million of that coming in June 2022, just six months ago, per GeekWire. The “realignment” is due to “recently achieved a breakthrough that will help [Atomo] reach a larger segment of consumers and more quickly advance accessibility to sustainable coffee offerings,” according to a statement attributed to CEO Andy Kleitsch.

After some digging, though, GeekWire found that Atomo’s workforce had grown to 50 employees according to LinkedIn, but the company’s former human resources director states to GeekWire that Atomo recently “let go of a lot of really valuable employees.”

Perhaps the particular vein of disruption being offered by some of the latest crop of venture-backed coffee tech companies isn’t really what the industry wants or needs, to say nothing of consumers, who anecdotally appear to be highly skeptical when it comes to actually spending money on most of this stuff. To be clear, it’s not to say that all capital investment in the coffee industry is bad, or that this approach can only lead to ruin. But one might reasonably wonder from all this recent news: after years of coffee tech and venture capital enjoying easy money together at the bar, might the bill be coming due?

Zac Cadwalader is the managing editor at Sprudge Media Network and a staff writer based in Dallas. Read more Zac Cadwalader on Sprudge.