Sprudge.com assistant editor Alex Bernson recently attended the 2013 Let’s Talk Coffee and Let’s Talk Roya conferences in El Salvador, produced by our friends and partners at Sustainable Harvest. Up above is a short video introduction to these events. Below are Mr. Bernson’s editorial takeaways on the dominant narrative at the conferences: the ongoing coffee leaf rust crisis in Latin America.

Does coffee leaf rust mean coffee will cost more? Comments for this feature are open.

Coffee leaf rust is an epidemic-scale challenge to the long-term availability of the global supply of quality coffee. The economic stakes involved in coffee rust are massive, for pretty much every company in the coffee supply chain, which can make it hard to parse through the marketing and develop an understanding of the actual facts of the issue, and what needs to be done about it.

However, at least amongst the types of experts presenting at conferences like the SCAA Symposium and Sustainable Harvest’s Let’s Talk Roya, a broad consensus seems to be emerging on the effects of coffee rust, and the steps necessary to combat it on the production side. We’ve tried to capture these current lines of thought with our feature on 11 Shocking Facts About Coffee Leaf Rust. What is still much less clear is what effects coffee rust will have for the consumer side of the industry. Is there going to be enough specialty coffee to drink in five years? Is it going to have to cost a lot more?

Coffee rust’s potential to decimate coffee production seems clear. Based on estimates from the national coffee growers associations, total Central American coffee production is down 32% in the last two years due to coffee rust. This has had real and immediate effects on the coffee industries of producing countries: according to Amy Angel of the Salvadoran Foundation for Economic and Social Development, coffee employed 181,000 workers in El Salvador in 2013, down from 326,000 in 2012. Historically, coffee leaf rust in Latin America has only affected commodity-quality coffee grown at low altitudes, but higher night-time temperatures and heavier rains caused by climate change means that rust is now affecting the higher altitudes where the best quality coffee is grown. I talked to farmers who reported rust effecting plants growing as high as 1700 meters this year, and this panel of experts Sprudge interviewed at the SCAA Symposium resoundingly agreed.

Coffee leaf rust doesn’t just affect production volume—it can also affect the taste of the coffee the farmers do successfully harvest. A panel of experienced cuppers at the Let’s Talk Roya conference found that rust-affected trees generally produce cups of coffee that tasted woodier and flatter. Ed Canty, the Fair Trade Organic Coffee Buyer for Green Mountain Coffee Roasters, also stated that coffee rust’s variable effects on quality have made it so that pre-ship samples, a standard tool green coffee buyers use to make purchasing decisions, are no longer as strongly predictive of the quality of the lots of coffee that are actually received. This means more uncertainty and risk for coffee buyers, and potentially less overall quality.

At a basic supply and demand level, declining production volumes and more variable quality would seem to indicate that high-quality coffee is going to become more expensive in the coming years. However, these effects might not become immediately apparent, especially at the more mass-market end of the quality spectrum, due to the artificial nature of the commodity coffee or “C” market. The C market is a commodity futures market run by ICE Futures in New York, and its movements and manipulations are not fully understandable, even by experienced brokers like Atlas Coffee Importers:

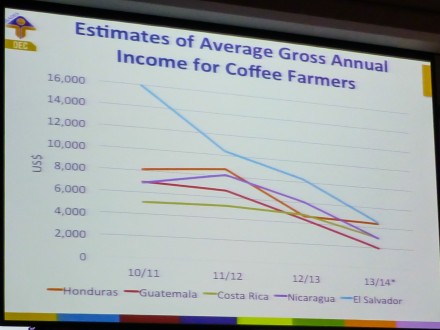

A major theme in the talks being given by coffee producers in the last year is how the C market is “broken” in that the price it dictates to coffee farmers is often below the cost of production in many countries. It is especially broken in that the price it dictates does not provide farmers with enough funds to make the long-term investments in total farm health necessary to combat coffee rust. Untangling the how-and-why of the C market’s artificiality is a task for a serious economist, but the fact remains that many farmers from some of specialty consumers’ favorite origin countries are finding it very hard to make the investments they need to.

What makes the situation especially complicated is that in some ways, the low C market price seems to suggest that coffee production is doing fine – that prices are low due to over-supply. There was in fact a bumper crop this year in Brazil and Colombia, thanks in part to extensive government investments to support coffee rust mitigation and replanting of new rust-resistant trees. But one thing that is crucial to understand about coffee is that it takes 3-4 years for a planted tree to start producing commercially, a lag which can seriously mute the price signals of the market and mask upcoming supply trends.

Colombia is the 2nd biggest Latin American exporter of specialty grade coffee behind Brazil, and they have replanted 40% of their coffee trees to fight rust. Those new trees are just now coming online, creating a big surge in supply, which is helping driving down a C market price that was already near historic lows due to a multitude of supply and trade manipulations. But that sort of growth in supply is not going to continue, especially since many other Latin American nations are just now starting to really experience the full brunt of coffee rust’s devastation. At the same time, demand for higher quality coffee, and for coffee from smaller origins, continues to increase.

It was hesitantly brought up a few times at Let’s Talk Roya: the combination of low prices and coffee rust is going to mean that some, perhaps many farmers, are going to have to stop growing coffee – and for some of the least healthy and productive farms, focusing on other crops may be a good thing. But the fact remains, the coffee supply of many countries, including some of the darling origins of the speciality coffee industry, is facing a serious threat. If coffee rust continues to decimate supplies and coffee prices continue to barely provide sustenance to farmers, nevermind space for investment in infrastructure, there is a good chance that many coffee origins will become dramatically harder to find, and may even fade from relevance entirely.

A recently announced $10 million initiative between Root Capital, a non-profit social investment fund, Green Mountain Coffee Roasters and other coffee roasters, the Multilateral Investment Fund (MIF) of the InterAmerican Development Bank and the Skoll Foundation seeks to help address the investment side of this problem.

Massive investments are going to need to be made across the specialty coffee spectrum. So where is that money going to come from?

With the recent spate of tsunamis and other disasters, an increasingly urgent question is being asked. Is it fair to ask developing nations to shoulder the brunt of the costs for what is ultimately a crisis fueled by climate change? Or is this something that must inevitably translate into higher prices for consumers’ daily cups?

Ultimately, the challenge of coffee rust is a challenge of end-to-end systemic sustainability for one of the world’s largest, most fragile agricultural commodities. In order to truly sustain production and guarantee a long-term supply of high quality coffee, producers across all levels and origins must be able to finance the improvements necessary to modernize and combat rust. The vagaries and obfuscations of the C market price have made it extremely hard for many producers, and producing governments, to invest in these improvements. This unsustainable situation can’t continue. Something has to change.

The price of a daily cup of coffee, or weekly bag of beans, is predicated on this unsustainable situation. If nothing is done and rust does dramatically cut supply, those same consumers would be looking at a massive price increase anyways. It seems wise to take that money and spend it on sustainability now instead of scarcity later.

If the consumer is going to be asked to shoulder this burden though, there’s going to need to be a clear, concise explanation as to why that money is necessary, and where it is actually going. This is an area where the premium end of the coffee spectrum is probably going to need to take the lead. As coffee prices increase, commodity roasters are far more likely to substitute robusta and lower quality arabica in their blends than market and roll-out sustainability-supporting price increases.

There doesn’t yet seem to be a quick, accessible, consumer-focused explanation of the problem of rust, and the fundamental sustainability issues underlying it. There’s not much on the charity side: I haven’t yet seen a website you can send your concerned Aunt to so she can read a bit and donate $5. [edited 12/11: Fair Trade USA has a website where consumers can directly send small donations here.] And there’s not much on the retail side yet, either. It’s still a struggle to convince consumers to pay more for coffee as a de-commoditized agricultural product period, never-mind as an agricultural product facing a sustainability crisis.

There are no comprehensive answers on the producing side. There are organizations like World Coffee Research and Catholic Relief Services that you can donate to, and hopefully partnerships like the Root Capital / Green Mountain / Sustainable Harvest initiative continue, but the best answer still seems to be working to strengthen what direct farmer relationships roasters already have. But at least we’re starting to see movement and coordination.

After spending six months attending specialty coffee events in three countries – the Nordic Barista Cup, the SCAA Symposium and SustHarv’s Let’s Talk events – the message being touted seems clear to me. Latin American coffee production is facing a potential ecological disaster, and even if this particular disaster doesn’t succeed in totally decimating some of the best loved coffee origins, the next one will, unless the whole trade situation is made more sustainable. The question is, how can we make that clear to a consumer in two minutes at a cafe, or in 20 words on a bag on the shelf? How can we convince coffee lovers to pay a premium for coffee that supports rust recovery? And how will any of us – consumers, producers, journalistic onlookers, enthusiasts, concerned aunts – really be sure that the premium is really helping with the immense of amount of work still to be done?

Alex Bernson (@AlexBernson) is the assistant editor at Sprudge.com. Read more Alex Bernson here.