Our friends and partners at Tim Wendelboe have just released their annual price transparency report for 2013. These sorts of reports are becoming increasingly popular–Counter Culture Coffee have been releasing theirs for four years and Coffee Bean International have been releasing theirs for three. This is the third year of TW reporting the prices they pay for green coffee. Tim Wendelboe has also done quite a bit of writing on their blog about coffee trade questions, and how coffee is still “too cheap.”

If you want to learn more about the nuts and bolts of how coffee is purchased, these kinds of reports can be a valuable point of entry. For what it’s worth, the release of reports like this one (and the annual Counter Culture report) have greatly this publication’s understanding of the global coffee chain. Let’s go through it together.

Tim Wendelboe is known for sharing lots of beautiful photos and interesting information from their work at origin, and they recently released a book on their work with Finca Tamana in Colombia.

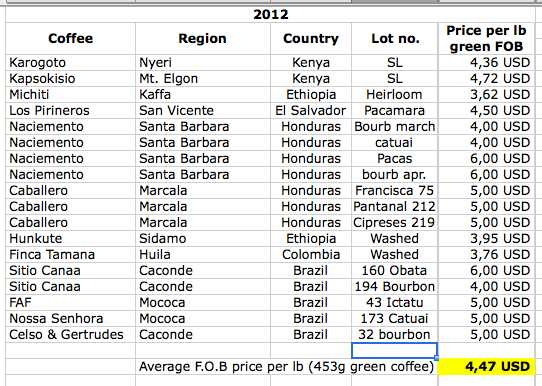

Their 2012 transparency report said that it had been “a challenging year for a lot of our farmers, fighting abnormal rain patterns, leaf rust, thefts of coffee etc.,” but that they were they were implementing new processing techniques and some of their “long term projects with our farmers are finally giving results.” They hoped that these developments would make 2013 a better year for quality coffee.

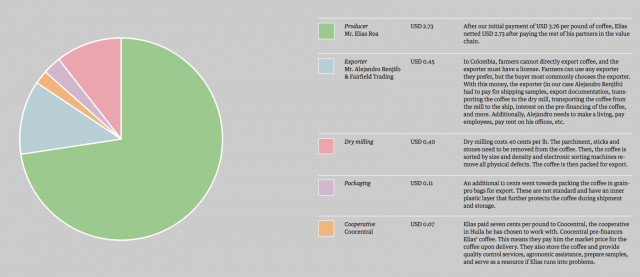

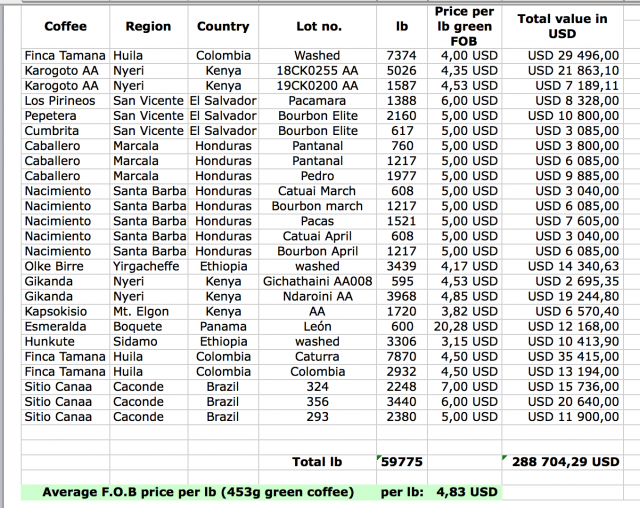

As you can see, in 2013 TW modestly increased the average price they paid for coffee, and also greatly increased the number of different lots of coffee they purchased. The price they paid Finca Tamana jumped from $3.76/lb to $4.50/lb, showing they potential payoff for focused work on improving quality. The transparency report also includes the graph below from the Finca Tamana book that breaks down where that money is actually going to.

All of these prices are FOB or “Free On Board” prices–the most common way of expressing green coffee prices (the C market commodity price is FOB). This expression of green coffee prices does not include what the coffee buyers pay in shipping, transportation, storage or taxes. This can make it hard to do direct comparisons of production costs and markups, but it is a great start for understanding the complex dynamics of international coffee trade.

Interrogate the whole set of data yourself right here via the Tim Wendelboe 2013 transparency report.