The Philadelphia Inquirer quietly announced Monday that Todd Carmichael and JP Iberti, the co-owners and co-founders of La Colombe Torrefaction, had recently received a round of funding valued at 28.5 million dollars. “We picked up an additional class of shareholders,” Carmichael told the Inquirer modestly, but he told Sprudge.com’s Alex Bernson much more in a phone interview the next day.

La Colombe’s been valuated at a whopping 66.5 million dollars, with a minority share being sold to a group of partners assembled by Goode Partners, a consumer products investment firm that matches shareholders with growth opportunities. Other clients include Skullcandy headphones and Dave’s Killer Bread, makers of the Sin Dawg. No formal press release has yet been issued because, as Carmichael told Sprudge, “that’d be dumb.”

Before the interview we’ve got two points of order. First: Todd Carmichael swears a lot–this interview has more swears in it than we publish in an entire average month of Sprudge. If swears make you squeamish, maybe have someone read you a bowdlerized version out loud or something. Second, and with full disclosure flags flying high: La Colombe Torrefaction are advertising clients partnered with this publication, though it should be noted, it was Sprudge who phoned them for this story. A full list of our current advertising partners is available on the right hand side of this and every feature published on Sprudge.

Alex Bernson: Let’s start with the craziest thing of all, the number. It’s a good chunk of money. You guys have certainly been growing recently. But this is a whole new round of growth…it seemed like you were on a pretty good expansion kick already, so what do you want to do with all this extra money to go beyond that?

Todd Carmichael: What’s the deal? Well the idea, the entire concept is real, solid specialty coffee expansion happens over five or ten years. I’m like most roasting companies in that I’m self-funded, we’ve always just sort of rolled everything over and rolled everything over. But when you get to a certain valuation, you say, “I think now we’re at the point where we can raise some capital to really kind of light that thing on fire.”

I’m really interested in a certain model of café. You’ve probably noticed I didn’t shy away from aggressive locations like 400 Lafayette and 4th and Mott in New York City, or Blogden Alley in Washington DC, but now I really want more footprint. I want more footprint.

And so I looked around to do it, and after twenty years I realized that the best way to achieve that is to raise some capital, man, so we can really kind of go and do the things we dream of.

So is this money going to be mainly focused on retail then?

Well we’re going to slice some off. We’re expanding the warehouse, what we call the roastery. We’ve pushed to our maximum volume there, so I’ve got to double up on the equipment. You know, nowadays, if you really want to add state-of-the art 240-kilo equipment, it’s a big ticket item, and I want it all to be perfect.

So there’s a little bit going into that.

I think Americans have something to offer by way of what the New Zealanders and Australians have been playing with for awhile, which is that kind of full menu coffee café experience. Particularly when you love baking, and you love making different things that go well with coffee. And that’s expensive. This café in Fishtown, I think the final ticket is going to be about 2 million dollars, just for the café. And I’d like to see multiples of those.

You want to see more full cafes, with a full menu?

Yeah. For example, I love the concept of different cafes–smaller ones–but I’d like to see a full on just punch-you-in-the-face 10,000 square foot Aussie-style full menu café in Manhattan. I think we’re there, you know, with the culture of it. And I’d like to see one of those in every city.

It’s fucking aggressive, right?

I mean, you’re not the first person to think it, but I’d be really curious to see you do it. Let me tell you, there’s nothing more lovely than having a cup of coffee with some toast and eggs, and like, getting your morning going. This is nothing revolutionary per se, but it’s great in a specialty coffee context.

Right?

And you know, rather than wait for restauraters to figure that out, to really do it well, I think that a coffee guy who has been around forever–who is familiar with all the suppliers, who has been in all these kitchens–a coffee guy that extends the menu, I think that is more natural. And ultimately I think it’ll be more successful.

We’ve seen it the other way around, and everyone’s like “it doesn’t seem to work that well,” but you know what? I had some of the best coffee I’ve ever had in these cafes in New Zealand and Australia…and went, “Fuck! This is awesome. If I were to live here, this is where I’d go.”

Well, then, that’s why I have to build it.

So it sounds like you spent a fair amount of time in Australia and New Zealand checking these things out. Were you actively looking for inspiration there?

I think it was just an active always looking for inspiration in every regard kind of thing. I was off doing some hiking and then I was visiting some chefs in New Zealand, and I went, “God, you just can’t ignore it, how beautiful it is.”

This is something I just think is natural. It’s a tough thing to do as a startup, but once you have 21 years behind you and you see that your company has gotten to a point where you can now begin leveraging it, like getting a mortgage on your company. Then you have that freedom.

The choice for us felt like it came after the SCAA. That was that mark of our 20 year anniversary and I really looked at it and I said: “Okay Todd, what are you going to do? Are you going to coast from here, or what are you going to do? Are you going to coast here? Or are you going to double down?”

I’m young enough. I’m going to double down. I want to see this thing through—I’ve got another decade.

So who are you working with? Who is investing in La Colombe?

It’s a collection of guys, some of them artists, some just great people I got the opportunity to meet, that was assembled for us by Goode Partners.

We’ve kissed a lot of frogs, I’ll be honest with you. I’m not known as the easiest guy on financiers. If you’re a traditional VC, it’s probably not going to work out.

We figured, why don’t we put a bunch of dudes together—and obviously my requirement was I had to meet everyone. They had to understand where I came from.

Individually JP and I are still the largest shareholders. That was really important to us, that we didn’t dilute it out—and the company has gotten to such a size that that is possible.

Can you share with me what the valuation was for this funding round or what percentage stake you guys are at?

We had a transaction value of $66.5 million dollars. That’s what we are valued at, done by both sides.

We’re responsible for more coffee then everyone realizes, I think. We roast a lot of it—we don’t do any branding outside of our own, but we have a really profitable wholesale. We’re touching close to 4 million pounds a year. And then the cafes are really very very busy, they’re really succesfull. 10 really bumping cafes, 4 million pounds, and then really strong mail order…it starts to add up.

You look around and are like, “How did this happen?”–but turns out if you grow at 18% a year for 20 years, you get it.

That 18% rate–is that part of why we’ve seen recent expansion in DC, Chicago and the rest?

Yeah, and we’re always growing and learning. La Colombe was started at a time when there was no fucking internet. We didn’t have a company cell phone. There wasn’t really a community yet like there is now. We’ve evolved in fits and starts at time in terms of our approach to the community and high end coffee, but like everything else, you stay in there and we’ve got our heads around it now.

We’re offering from the geeks to the chefs, and it’s really showing in our numbers.

Can you tell me anything more about whom the specific new investors are at La Colombe? I ask because when James Freeman of Blue Bottle took on his latest round of investment, the list of investors published by True Ventures read like a Who’s Who of tech investors coming out of their San Francisco market.

I think the commonality in the investors from Goode is that they’re artists. They get it, they get craft. I don’t consider myself an artist, but I think an artist can relate to what we’re trying to do. They’re not techies—we could use a couple for our website though!

You know when it happened, we turned to each other and said, “Do we do a press release that we raised all this money?” Well, that’d be dumb, because it’d be going to all these business pages and I don’t read them and I don’t give a fuck what they say. But I could see it being interesting in coffee.

I’m hoping people don’t perceive it as aggression—it’s not. I don’t feel at any point that I’m going to raise a bunch of money and I’m gonna drown a bunch of my friends, open a million cafes. That’s not the intent of it.

The intent is, this is our time, let’s make the most of it.

For next steps, like more full-menu concept cafes, are you bringing in new people or trying to hire internally?

I want to be able to offer my guys always a way up, to keep the best talent there’s got to be opportunity around. The interesting thing now is, we have a whole new class of people focused on a different area. The café has the coffee bar manager who manages the coffee, but then the whole footprint requires a GM. Every place gets a baker–a proven baker, not just someone puffing up croissants and jamming them in the oven. Then the kitchen is run by a chef.

I went around to a lot of people who were in-between positions, and I grabbed the best ones. Our baker [for Fishtown] has been with us for a year now, doing experimental baking. Our chef has been working on recipes with JP for about 2 months.

Is Fishtown the model you’re looking to go with going forward?

Well I don’t think every city in the world wants me cranking out rum in their retail, the permitting and all that is hard to get around.

But the full menu café part of it, having a baker and all that?

That’s it man. It’s not an idea that I had on my own, it’s just I’m the only crazy one to put his money down—you can’t do it for less than a million and half, that’s what it’s going to cost you. We’ll put down two with everything in it, and that’s tough to do. It’s scary as shit!

Last question.

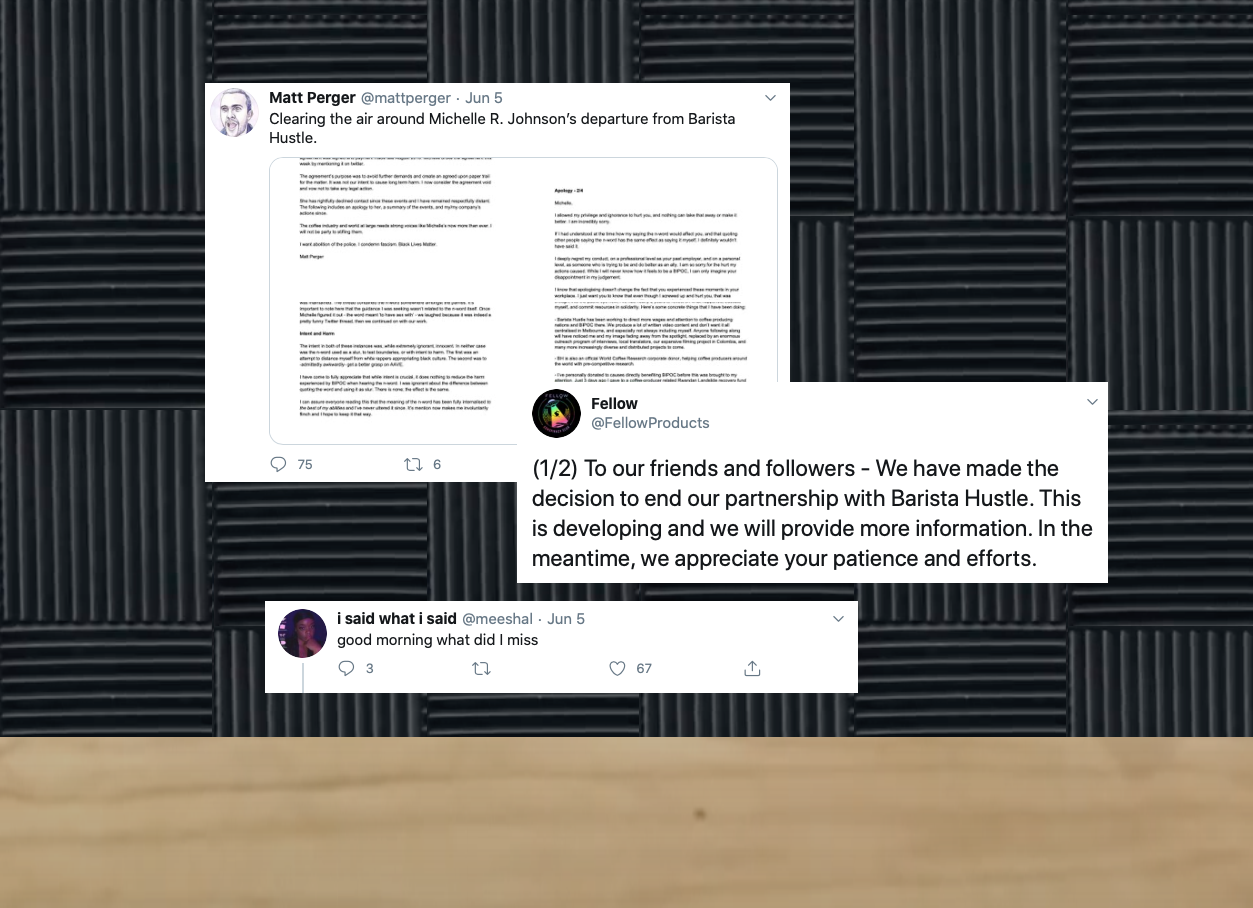

On the subject of investments in other coffee companies, well…it’s poetic that you’re trying to do an Australian style café, because investment is something that’s much more common in that market. But here in the United States, it’s still just starting to happen. It happened with Blue Bottle, and of course it happened prior to that with Stumptown Coffee Roasters.

When it happened with Stumptown, you were publicly quite vociferously against that move. In fact, you wrote that TSG’s investment in Stumptown amounted to, and I quote, “Duane Sorenson selling his life’s work to the highest bidder.”

How do you see your own round of investment in light of that?

I’m still vehemently against the concept of cashing out your chips but pretending you’re still in it. This is just something that I don’t like.

We’re in an industry that’s transparent, and you know, selling your company but then saying you’re still in it is one thing, but raising money for your company to be even better is another. I was very careful when I was approaching investors to let them know that’s not what I’m doing.

If you take those millions and put that in your pocket and leave, or you raise the money and it stays within the company, that’s a different story. Having said that, I think you’ve always got to be careful who you’re doing business with. I was cautious 21 years ago when I chose to go into business with JP, and I was just as cautious deciding who was going to be the third partner.

I mean, I recognize I’m going to die. I’m going to get fucking old. There’s probably going to be a time when I dump a big chunk of this company and I disappear because I’m old and I’m in a wheelchair. That day will come. But I will tell people I’m selling out when that happens, that I’m retiring. I won’t tell people shit like: “I’m still the owner, but I sold the company.”

The backstory with that—I mean…we had a huge falling out. Duane and I have really patched that up over time. And you know, I wouldn’t be surprised if he thought just like I said back then. It’s tough. But the craftsman has to be the boss, he has to be the main owner. That’s just how I feel.

Alright. Thanks for your time.

Alex Bernson (@AlexBernson) is the Assistant Editor at Sprudge.com. Read more Bernson here.