After raising $45 million in its latest round of funding, Blue Bottle Coffee is now extending healthcare benefits to its employees’ dependents, and plans to offer retirement benefits as well. When I read that in this piece on Valleywag, it struck me as a positive attempt by Blue Bottle to stand out from the pack, since in our 2013 survey on barista health, we found that that 60% of coffee workers receive no health benefits from their employer.

This recent disclosure of Blue Bottle’s benefits got me curious though: just how do Blue Bottle’s benefits stack up next to some of their peers in the industry? Over many years working bar, I had heard the hushed, incredulous rumors about “benefits”—those mythical components of a sustainable, “professional” coffee-making existence—but a life of being able to comfortably afford medical care did not seem to be the reality for most baristas and their families. If that’s changing, it’s fantastic news.

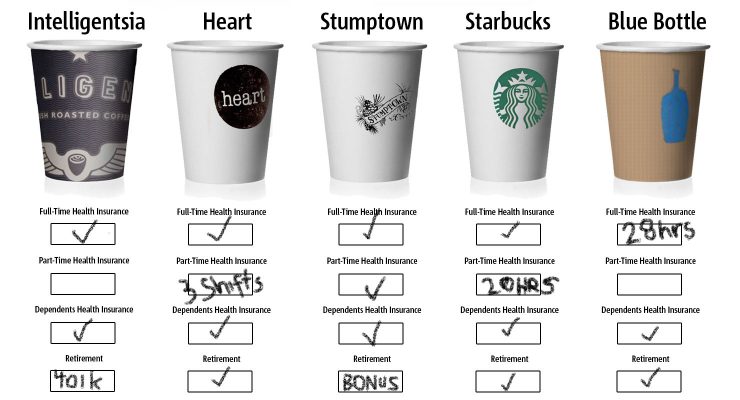

To find out, I asked a number of companies about their benefits: Intelligentsia and Stumptown, two US specialty coffee companies with a similar retail scale to Blue Bottle; Heart Coffee Roasters, a cutting-edge independent cafe a fraction of those companies’ size; and for a wider reference point, Starbucks, who in 2013 employed more than 200,000 people worldwide. Here’s how these five coffee companies stack up in the benefits they offer their employees:

Before getting into these findings, a few disclaimers. First, Blue Bottle, Intelligentsia and Stumptown are all advertising partners of this site, and the information is based on what they self-reported. Second, I am biased towards humans having affordable access to health care, which in the United States unfortunately means having it offered by employers. Third, the Valleywag article which spawned my initial curiosity took approximately the opposite reading of Blue Bottle’s press release in every way, focusing on Blue Bottle’s cutting of health benefits to their part-time employees as part of their benefit restructuring. More on that later.

As you can see from the chart above, all of these companies actually offer similar benefits to their employees, with some interesting twists in the backstory. For example, Blue Bottle’s new dependent health benefits bring them more in line with Intelligentsia’s offerings, but Intelligentsia has offered those health benefits since their founding in 1995. Still, as the two most comparably-sized retail outfits, Intelligentsia and Blue Bottle face many of the same challenges and address them in some of the same ways: neither company offers benefits to part-time workers, but according to Intelligentsia’s human resources director Lisa Hogan, part-time workers represent a miniscule percentage of their workforce, and Blue Bottle made the same staffing note in their statement to Valleywag.

Wille Yli-Luoma, owner of Heart Coffee, suggested offering health insurance at bigger companies can be easier because of the discounts they could get with their larger staff sizes. With just two cafes, Yli-Luoma said that offering benefits to his employees was a big challenge, but something he saw as crucial for supporting and retaining a talented, dedicated staff. He also made the point that what constitutes “full-time” and “part-time” is often different for baristas due to the shorter length of coffee shifts—Heart requires that all employees work a minimum of three shifts a week, which works out to approximately the same level as Starbucks’ requirement of at least 20 hours of work a week for benefits eligibility, all of which is not that much lower than the 28 hours per week Blue Bottle now requires for health benefit eligibility.

Starbucks has a bit of a reputation for its pro-benefits stance, with a wide array of health and other benefits spelled out in a 13-page guide to a program the company calls “Your Special Blend”, which includes a “Future Roast” 401k plan and two different stock rewards plans. Mary Ellen Signer at Stumptown echoed the importance of supporting employees and their families, and explained the unique approach they take to retirement savings, called the “kicker check.” Introduced four years ago, the program pays out 3% of gross base wages as a cash bonus to all employees when the company is having a “good year”, which so far has been paid out three times. Signer says this policy is designed to acknowledge the many different places in life and histories with the company that their employees have—while setting up a retirement plan may be best for some employees (and Stumptown offers counselors to help set up 401(k) plans), other employees may be better served paying off loans or other expenses.

While coffee wages may still be rather low, it does sound like at least amongst this small sampling of leading coffee shops, there are a good amount of benefits being offered to employees. Digging into the actual premiums and coverages offered by each company would paint a fuller picture—particularly with a wage comparison. But I think it can be said that there is a good degree of parity between all of these companies’ benefits, now that Blue Bottle has expanded their coverage. All of which sounds like praiseworthy steps towards more sustainable barista life.

If that’s the case, then why did the Valleywag piece take such a different tack? Well to start with, Valleywag, one of the Gawker Media properties, is known to take critical stands against the run-amok Bay Area tech culture and some of its most shady business practices; and it must be noted that “Blue Bottle, Which Raised $45 M, Cut Health Benefits for Part-Timers” is a hell of a clicky headline, especially right before Thanksgiving. It does indeed suck that six percent of Blue Bottle’s work force is losing benefits they had, even if Blue Bottle is now offering benefits to the other 94% of their workforce that are comparable to other leading coffee outlets.

If growing the industry to the point where all coffee workers, not just the lucky few at leading coffee companies, have access to health care means some stumbling along the way, I think that seems like a pretty fair trade. The general lack of affordable healthcare available to service workers is a gigantic, complicated problem in the United States. Addressing it requires not just advocacy and critique, but a lot of pragmatic, incremental action towards improvement.

Of course, a quick look at five companies can only barely scratch the surface of this issue. Did your favorite roaster or retail company not get mentioned? We’d love to know more about their health care practices. Let us know in the comments below, email us at healthcare@sprudge.com, or sound off on Twitter.

Alex Bernson is the Managing Editor at Sprudge.com. Read more Alex Bernson on Sprudge.